EPIC’s Mobile Wallet Platform transforms the Maldivian payment ecosystem

Bank of Maldives PLC (BML) is the premier bank in the Maldives Islands dominating the retail banking segment, accounting to over 90% of the population in its banking radar. In June 2016, BML launched the flagship BML MobilePay to the Maldivian market which is fully designed and crafted by Epic Lanka to deliver superlative payment experiences to their consumers. BML customers experienced a new dimension in banking with a greater digitalized component with significant benefits.

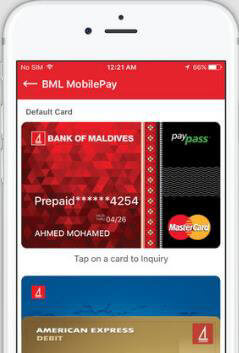

EPIC Mobile Wallet Platform is a state-of-the-art solution which transforms the customer mobile phone into a truly digital and more secure version of a traditional wallet with the ability to register all BML issued debit, credit, and prepaid cards. The downloadable MobilePay Application provides an unparalleled level of simplicity for customers to conduct payments to merchants and other wide variety of banking and non-banking transactions using any of their registered payment instruments right from the comfort of their mobile device.

As the technology partner, we remain engaged with BML to ensure the platform evolves with the changing needs of consumers. This includes enabling value-added features, updating additional functions and facilities in the application and providing platform-level support to ensure high-availability and peak performances.

A platform to move to a cashless and cardless digitized practice

The whole objective in our engagement with Bank of Maldives was to drive the development and modernization of the country’s payment ecosystem, promote financial transparency and accountability, reduce transaction costs and decrease the size of the grey or informal economy. It also lessens the dependency on physical currency hence decreasing the burden on the Financial Ministry to print/mint legal tender.

Mobile payments will go mainstream in the near future. With more than five billion in the world having access to a mobile device, and that figure is expected to grow, electronic payments via mobile devices will become more commonplace than ever before.

Key Drivers

It is deduced that over 90% of the transactions we perform on a day-to-day basis accounts to be merchant payments. Yet, most of the Mobile Banking Solutions currently in the market caters to the remaining 10% transactions and do not address the essential merchant payments facet.

Solution Offerings

The BML MobilePay promotes mobile phones as a single point transaction initiator while providing versatile transactional capabilities to drive widespread consumer acceptance. It delivers an innovative and ultra-modern closed-loop merchant payment process, eliminating transaction commissions to international card associations.

Sending money to family and friends, locally or internationally, top-ups within registered instruments, transferring funds to other BML MobilePay users, checking card balances, viewing card transaction history, and mini statements are some of the transactions that customers can enjoy from among the several other the solution offers.

Unlike most of the wallet apps, our solution supports merchant payments using all of a customer’s payment instruments on existing POS infrastructure using only their mobile phones.

Seamless and hassle-free customer on-boarding process

Through this solution, existing customers are enrolled through a simple on-boarding process to establish KYC with no cumbersome registration activities. This provides a differentiating experience to customers when compared to the tedious signing up procedures that are seen in the market today.

Consolidate multiple payment instruments to a single platform

The solution enables multiple payment instruments to be enrolled within a single electronic mobile wallet thus eliminating the need to remember multiple PINs/passwords. Users will show a greater inclination towards the use of a single device for all of their payment instruments in order to avoid the hassles and inconvenience. In such an environment, the need for carrying multiple devices or switching between devices is eliminated.

Multiple transaction initiation mechanisms

Due to its unique design, the solution could be operated with or without NFC infrastructure. It provides alternative modes of transactions – NFC based, Mobile Number based or QR Code based, in order to initiate payment at a merchant counter. This allows eWallets to be promoted seamlessly across the entire customer segments.

It is as simple as making payments by tapping the mobile device on the merchant terminal if the devices are NFC-enabled or paying for delivery services while at home or on the go by just giving out the mobile number or simply scanning the merchant’s QR code.

Catering to the entire merchant acquiring ecosystem

The solution is uniquely positioned to expand the merchant acquiring capability across the pyramid of socio-economic groups thereby providing financial inclusion to the underbanked merchant segments.

Fortified with top-of-the-line security

The solution is engineered with our pioneering tokenization methodology which negates the need for any sensitive card information to be stored on the phone or transmitted during a transaction, thus ensuring the security and privacy of the payment instrument details to a significant degree.

The application can only be accessed by a user-defined PIN and any repeated failed attempts will lock-out the application to prevent unauthorized usage.

Mohamed Shareef, Deputy CEO and Director of Operation at BML commented: “We are the premier bank in the Maldives representing to more than 90% of accounts from the people of the Maldives. One reason for us to be ahead of other banks is the introduction of novel and cutting-edge technology to our customers. ‘BML MobilePay’ is one such tool which has created a major disruptive impact and the response is overwhelming”.

“The prime reason for choosing Epic Lanka as our preferred partner to develop this platform from among several other global players was because of Epic’s unblemished performance record when it comes to innovation, engineering expertise, and commitment to delivery. They are known over the world for their novel innovations and we had no second thoughts to award this contract to them,” he further said.